Introduction: Why Payroll & Compensation Matter

Payroll is more than just “issuing salaries.” It is the foundation of trust between an organization and its workforce. Errors in payroll can damage credibility, lower morale, and even lead to legal penalties. Compensation, on the other hand, is the strategic art of rewarding employees fairly and competitively, ensuring motivation and retention.

At Curiosity Tech , payroll is handled not as a back-office routine, but as a core HR pillar. With employees spread across diverse roles — from developers and trainers to project managers — ensuring accurate and timely payroll has been key to the company’s reputation as an ethical employer.

Step 1: Understanding Payroll Basics

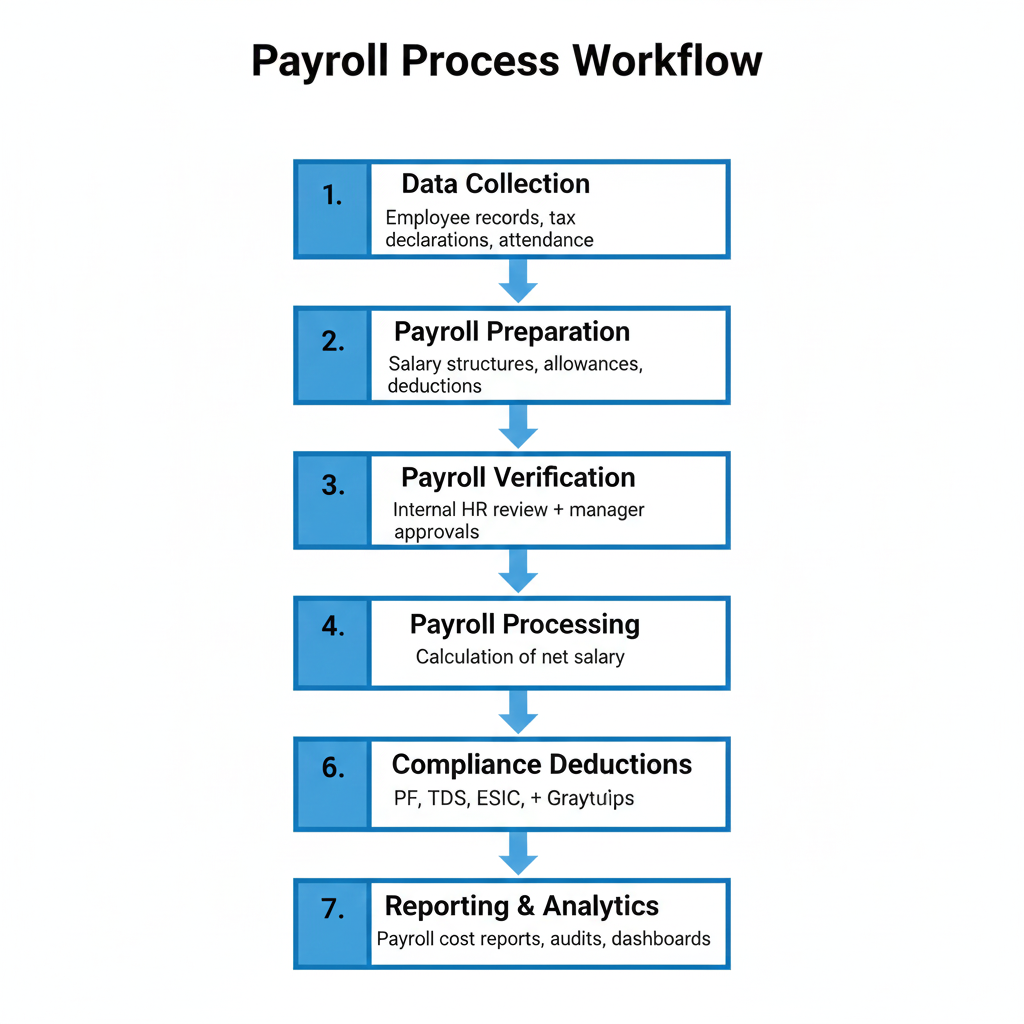

Payroll is a systematic process involving:

- Employee Information Collection :-

- Bank details, PAN, Aadhaar, joining dates, salary structure.

- Curiosity Tech ensures this via HRIS digital onboarding forms.

- Attendance & Time Tracking :-

- Integration of biometric systems or online attendance.

- Remote teams log hours using cloud-based trackers.

- Salary Calculation :-

- Basic Pay + Allowances – Deductions = Net Salary.

- Compliance & Taxes :-

- PF, ESIC, TDS, Professional Tax, Gratuity, Bonus Act.

- Mistakes here can lead to penalties from Indian labor laws.

- Salary Disbursement :-

- Direct bank transfers on fixed dates (e.g., 30th of every month at Curiosity Tech).

- Payslip Generation :-

- Transparent record for employees (digital payslips through HRIS portal).

Step 2: Compensation Strategy Basics

Compensation isn’t just about salary. It includes:

- Fixed Pay (salary components)

- Variable Pay (performance incentives).

- Benefits (healthcare, insurance, leaves).

- Non-monetary rewards (recognition, flexibility, learning opportunities).

At Curiosity Tech, the compensation philosophy is :- “Reward fairly, recognize transparently, and align pay with growth.”

Step 3: Payroll Process Workflow (Hierarchical Diagram)

Step 4: Legal Compliance Every HR Manager Must Know

- Payment of Wages Act (1936) – Timely payment of salaries.

- Minimum Wages Act (1948) – Salaries cannot fall below legal limits.

- Payment of Bonus Act (1965) – Minimum 8.33% of wages for eligible employees.

- Employees’ Provident Fund Act (1952) – Mandatory PF contributions.

- Income Tax Act (1961) – Deduction of TDS and proper filing.

CuriosityTech.in highlights these compliance rules during its HR manager training workshops, ensuring zero tolerance for payroll errors.

Step 5: Common Payroll Challenges & Solutions

| Challenge | Impact | Solution at Curiosity Tech |

| Misclassification of employees | Wrong deductions | Use HRIS tagging by role type |

| Manual errors in calculations | Salary disputes | Automated payroll software |

| Compliance penalties | Financial & reputational loss | Periodic audits |

| Late disbursements | Employee dissatisfaction | Bank integration with payroll system |

Step 6: Compensation Design – Strategic View

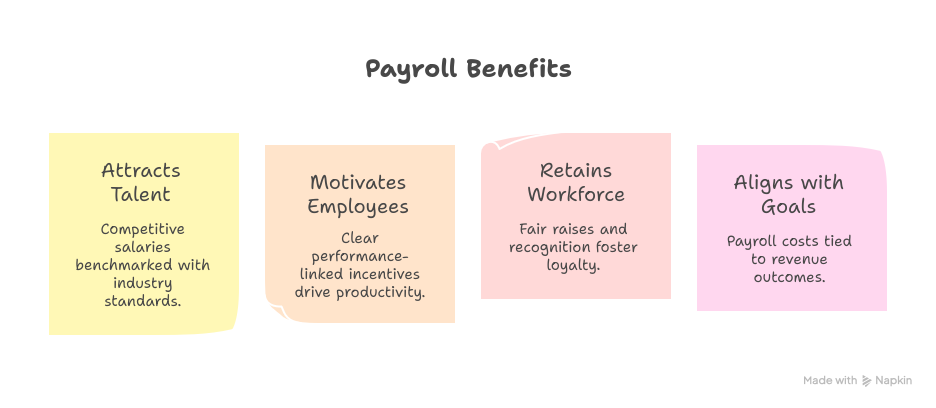

A well-designed compensation structure:

- Attracts Talent – Competitive salaries benchmarked with industry.

- Motivates Employees – Clear performance-linked incentives.

- Retains Workforce – Fair raises and recognition.

- Aligns with Business Goals – Payroll costs tied to revenue outcomes.

At Curiosity Tech (contact@curiositytech.in | +91-9860555369), compensation reviews are conducted twice a year, combining market benchmarking with employee performance data from HR Analytics (Day 10’s foundation).

Step 7: Digital Payroll Systems in 2025

Modern HR managers cannot rely on Excel sheets alone. Tools now include:

- HRIS (Human Resource Information Systems)

- Cloud-based Payroll Software

- AI-Powered Tax Compliance Calculators

- Employee Self-Service Portals

Curiosity Tech integrated payroll with attendance, performance, and training systems, creating a single source of truth.

Step 8: Case Example – Curiosity Tech’s Payroll Transformation

Before (2018):

- Manual payroll on Excel sheets.

- Frequent delays & disputes.

- High compliance risk.

After (2025):

- Cloud HRIS + automated salary calculation.

- Zero disputes in past 3 years.

- Payroll processing time reduced from 10 days → 2 days.

- Employees access payslips via employee portal (curiositytech.in)

Step 9: Becoming an Expert in Payroll & Compensation

An HR manager must:

- Learn compliance laws deeply.

- Understand compensation strategy beyond salary.

- Master HRIS tools.

- Regularly audit payroll reports.

- Stay updated with government regulations.

Expertise comes not from theory alone, but hands-on execution — exactly how HR leaders at Curiosity Tech, Nagpur (1st Floor, Plot No 81, Wardha Rd, Gajanan Nagar) built credibility.

Conclusion

Payroll & compensation are the heartbeats of HR operations. When done right, they create a culture of trust, fairness, and transparency. When done wrong, they risk employee morale, compliance fines, and brand reputation.

At Curiosity Tech, payroll has evolved into a strategic business function, aligning compensation with engagement, performance, and retention. For HR managers, mastering payroll isn’t optional — it’s the core skill that makes or breaks careers.